investment advisory

rule-governed, robust & transparent

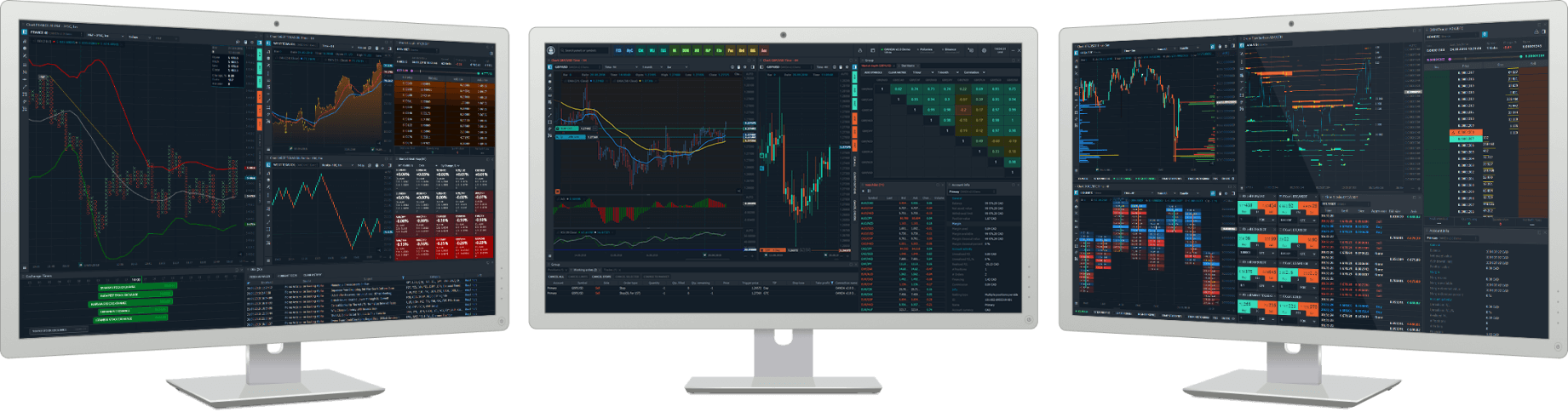

effected with

an in-house workbench developed for digital processing of trading algorithms, money management and trade execution.